This maximum investment amount is decided by the government. In addition the tax credit limitation for certain RD venture corporations ie.

4 Ways To Reduce Your Income Tax In 2017

Based on the income tax slab an individual falls into they do their maximum tax saving.

. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D. Corporations established in the past ten years or less with carryforward losses and that are not a subsidiary of a large corporation is 40 of the corporate tax liability while the rate of 25 is. However every section amongst these has a pre-set maximum investment amount.

The upper limit of the tax credit ratio of 10 is temporarily increased to 14 until 31 March 2021.

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

A Retiree Tax Break On Charitable Donations Is Back Here S How To Use It The Washington Post

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

Updated Guide On Donations And Gifts Tax Deductions

Tax Exemptions Deductions And Credits Explained Taxact Blog

Updated Guide On Donations And Gifts Tax Deductions

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

30 Fundraising Ideas For Booster Clubs Sports Betting Sports Football

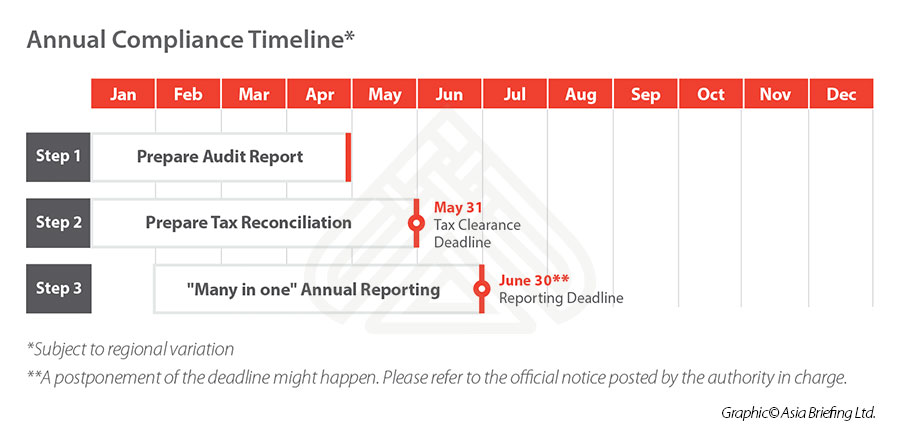

Preparing For Annual Tax Reconciliation In China In 2021 Faqs

Irs Form 3903 Are Moving Expenses Tax Deductible Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)